Nutanix Reports Third Quarter Fiscal 2018

Nutanix, Inc. (NASDAQ: NTNX), a leader in enterprise cloud computing, recently announced their financial results for its third quarter of fiscal 2018, ended April 30, 2018.

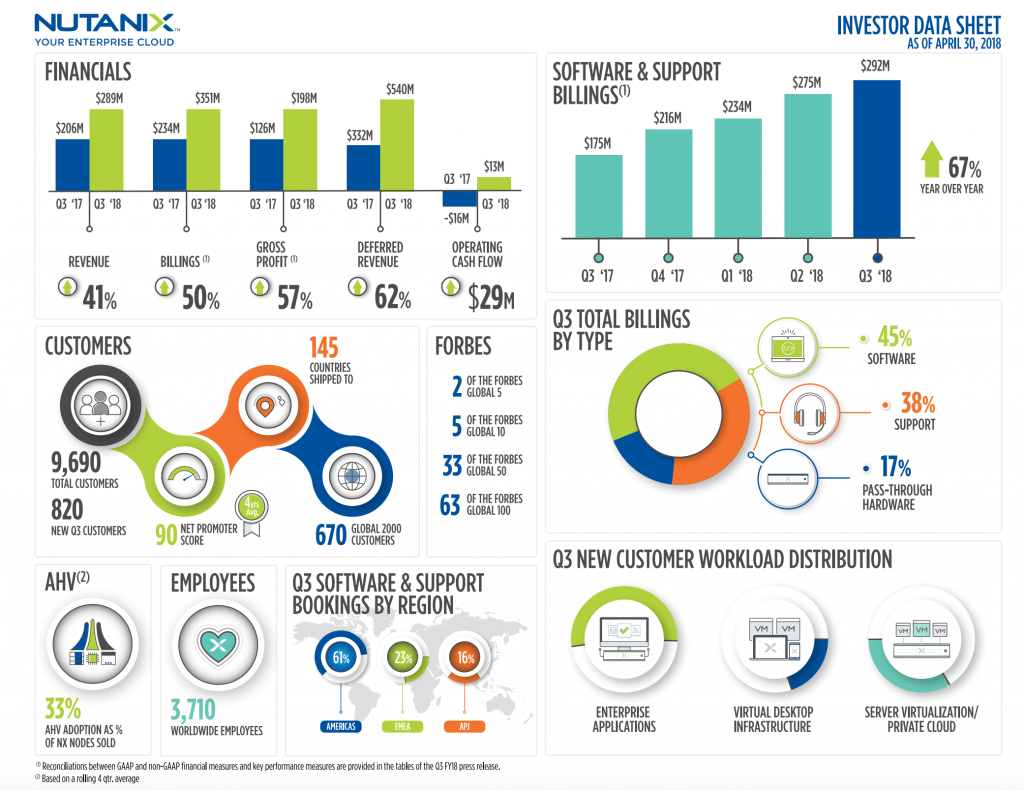

Third Quarter Fiscal 2018 Financial Highlights

- Revenue: $289.4 million, growing 41% year-over-year from $205.7 million in the third quarter of fiscal 2017, reflecting the elimination of approximately $52 million in pass-through hardware revenue in the quarter as the company executes its shift toward increasing software revenue*

- Billings: $351.2 million, growing 50% year-over-year from $234.1 million in the third quarter of fiscal 2017

- Gross Profit: GAAP gross profit of $193.8 million, up 58% year-over-year from $122.5 million in the third quarter of fiscal 2017; Non-GAAP gross profit of $197.8 million, up 57% year-over-year from $125.9 million in the third quarter of fiscal 2017

- Gross Margin: GAAP gross margin of 67.0%, up from 59.5% in the third quarter of fiscal 2017; Non-GAAP gross margin of 68.4%, up from 61.2% in the third quarter of fiscal 2017

- Net Loss: GAAP net loss of $85.7 million, compared to a GAAP net loss of $96.8 million in the third quarter of fiscal 2017; Non-GAAP net loss of $34.6 million, compared to a non-GAAP net loss of $45.7 million in the third quarter of fiscal 2017

- Net Loss Per Share: GAAP net loss per share of $0.51, compared to a GAAP net loss per share of $0.67 in the third quarter of fiscal 2017; Non-GAAP net loss per share of $0.21, compared to a non-GAAP net loss per share of $0.32 in the third quarter of fiscal 2017

- Cash and Short-term Investments: $923.5 million, up 164% from the third quarter of fiscal 2017

- Deferred Revenue: $539.9 million, up 62% from the third quarter of fiscal 2017

- Operating Cash Flow: $13.3 million, compared to $(16.0) million in the third quarter of fiscal 2017

- Free Cash Flow: $(0.8) million, compared to $(29.2) million in the third quarter of fiscal 2017

Reconciliations between GAAP and non-GAAP financial measures and key performance measures are provided in the tables of this press release.

“Investment in our innovation engine is delivering strong results. At .NEXT, we introduced major new products that extend our unique consumer-grade value into security, networking, database operations, and multi-cloud markets,” said Dheeraj Pandey, Chairman, Founder and CEO of Nutanix. “Our continued industry-leading Net Promoter Score proves that a relentless focus on our customers drives our continued success.”

“Demand for our solutions remains strong as we saw 67 percent growth in software and support billings and 55 percent growth in software and support revenue. We had strong success in our hiring in the quarter that positions us to deliver on our future growth plans, as we outlined at our March Investor Day,” said Duston Williams, CFO of Nutanix. “The continued growth in our software and support billings and gross margin expansion in the quarter demonstrates we are successfully executing on our transition to a software-defined business model.”

Recent Company Highlights

- Acquired Netsil, Inc.: Completed the acquisition of Netsil, Inc., a provider of application discovery and operations management that enables state-of-the-art observability in modern distributed cloud environments.

- Executed on Transition to Software-Defined Business Model: Grew software and support billings by 67 percent year-over-year, including three software and support deals worth more than $5 million each. Pass-through hardware billings decreased to 17 percent of total billings in the quarter, down from 25 percent in the year-ago quarter.

- Improved AHV Penetration: Grew adoption of AHV, the company’s built-in hypervisor, to 33%, based on a fourquarter rolling average of nodes using AHV as a percentage of NX nodes sold.

- Expanded Customer Base: Nutanix ended the third quarter of fiscal 2018 with 9,690 end-customers, adding 820 new end-customers during the quarter and growing deals greater than $1 million by 28 percent year-over-year.

- Announced Three New Innovative Products for Multi-Cloud Environments:

- Nutanix Flow, which completes its core infrastructure services offering and provides customers with a software-defined networking solution for the multi-cloud era. Nutanix Flow solves customers’ security concerns through a unique application-centric focus combined with native virtual machine (VM) microsegmentation that protects against internal and external threats.

- Nutanix Era, which expands on the company’s platform services offering. Beginning with Copy Data Management (CDM), Nutanix Era empowers database administrators to clone, restore, and refresh their databases to any point in time leveraging a virtual time-machine. Copy Data Management, along with other planned offerings from Nutanix Era, enables companies to address the complexity and cost of data sprawl with a sophisticated service that makes complex database operations simple.

- Nutanix Beam, which introduces the company’s first software-as-a-service offering to the market. Nutanix Beam enables IT managers to visualize, predict and manage cost, security, and regulations across multiple clouds. This offering helps application owners with the unexpectedly high costs of their cloud services and the lack of visibility and control of their service consumption.

- Increased Participation in 4th Annual .NEXT Conference: Nearly 5,000 attendees with 35+ customer speakers, 40+ partner sponsors, and keynote addresses from visionaries including Anthony Bourdain and renowned TED talk speaker Dr. Brené Brown; partners including Jason Lochhead, CTO, Infrastructure, Cyxtera; customers including Vijay Luthra, SVP, Global Head Of Technology Infrastructure Services, Northern Trust – Chicago; and strategic alliances including Brian Stevens, Chief Technology Officer of Google Cloud. Additionally, the company hosted 20,000+ attendees at .NEXT events around the world over the past year.

- Hired New MD of Operations in India: Hired Sankalp Saxena as Senior Vice President and Managing Director of Operations of its India subsidiary to lead its India operations and execute on the company’s growth strategy, including product innovation, talent acquisition, and brand building.

- Named as a Top Public Cloud Company to Work For: Glassdoor and Battery Ventures ranked Nutanix one of the top 10 public cloud computing companies to work for in a recent report.

Q4 Fiscal 2018 Financial Outlook

For the fourth quarter of fiscal 2018, Nutanix expects:

- Revenues between $295 and $300 million; assuming the elimination of approximately $95 million in pass-through hardware revenue* and an increased billings-to-revenue ratio of 1.25;

- Non-GAAP gross margin between 73% and 74%;

- Non-GAAP operating expenses between $250 and $260 million;

- Non-GAAP net loss per share between $0.20 and $0.22, using 171 million weighted shares outstanding.

*The elimination of hardware revenue is based on the estimated cost of hardware in transactions where our customers purchase such hardware directly from our contract manufacturers.

Supplementary materials to this earnings release, including the company’s third quarter fiscal 2018 investor presentation, can be found at https://ir.nutanix.com/company/financial/.